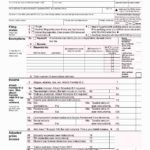

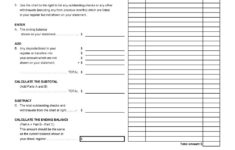

A Qualified Dividends And Capital Gain Tax Worksheet 2016 is a few short questionnaires on a certain topic. A worksheet can be ready for any subject. Topic could be a complete lesson in one or simply a small sub-topic. Worksheet work extremely well for revising the subject for assessments, recapitulation, helping the students to recognize individual more precisely or to improve the feeling covering the topic.

Objectives of a Qualified Dividends And Capital Gain Tax Worksheet 2016

Qualified Dividends And Capital Gain Tax Worksheet 2016 must be child friendly. The difficulty level on the worksheet should really be minimum. Worksheet need to have clarity in questioning avoiding any ambiguity. Within the worksheet the questions shouldn’t have a couple of possible answer. Worksheet should serve as a tool to increase content from a child. Worksheet has to be pictorial. Worksheet ought to be include skills which includes drawing, analyzing, descriptive, reasoning etc. Worksheet have to be short only 2 pages else it would called being a Workbook.

Producing a Qualified Dividends And Capital Gain Tax Worksheet 2016 Easily

Generating a Qualified Dividends And Capital Gain Tax Worksheet 2016 seriously isn’t a fairly easy task. The worksheet have to be short, crisp, simple and easy child friendly. Various skills involved in designing a worksheet, forms of worksheets, and sample worksheets are explained in detail. Traditionally the worksheets are prepared in various subjects and this can be short or elaborate, with or without pictures. The latest innovative accessible variety of worksheet formulated for designing a worksheet would be the 3 E’s Worksheet method. For students both these worksheets are EASY, ENJOYABLE and EFFORTLESS. The worksheets would rekindle the teaching-learning approach to student for the conclusion of worksheet. It will take maximum of around 10 min to finish each worksheet. Skills included are applicative, conceptual understanding, diagrammatic, labeling and identification of terms.

Qualified Dividends And Capital Gain Tax Worksheet 2016 Can Be Utilized For Some Goal

Qualified Dividends And Capital Gain Tax Worksheet 2016 work extremely well by using a teacher/tutor/parent to enrich necessary . an understanding of their student/child. Worksheets can be utilized as being a testing tool to discover the Scholastic Aptitude and Mental Aptitude of child during admission procedures. Worksheets is usually prepared as the feedback activity after an area trip, study tour, educational trip, etc. Worksheets can be utilized as a device to offer extra knowledge and to observe the improvement of this skills in students such as reading, comprehensive, analytical, illustrative etc. Worksheet helps the student to excel in an actual issue.

Greatest things about a Qualified Dividends And Capital Gain Tax Worksheet 2016

Qualified Dividends And Capital Gain Tax Worksheet 2016 is among the most handy tool for that teacher. Student must just substitute the worksheet. Since most of the challenge is been already printed for him. So he/she feels happy to finish it faster. Worksheet shows the student the essential revision more than a topic. Student shall improve his application skills (ex: begin to see the ‘Answer during a word’in the very best sample worksheet). A worksheet could be used to test any mode of learning like diagrams, elaborate writing, puzzling, quizzing, paragraph writing, picture reading, experiments etc. Worksheets may just be designed for the’Gifted Children’giving more inputs about the given topic beyond the textual knowledge. Worksheets is a helping hand to ensure the amount of understanding to the’Slow Learners’.

Disadvantages of Qualified Dividends And Capital Gain Tax Worksheet 2016

As looking at their home, every coin has two sides. Qualified Dividends And Capital Gain Tax Worksheet 2016 have many advantages but some disadvantages. A statutory caution can be given, “Never use excessive worksheets”. Worksheets is often given like a revision for the lesson after teaching that lesson or may very well be given throughout the completion within the lesson as a possible assignment to evaluate the idea of the child. Student becomes habitual to writing precise answers. Student gets habitual for that prompting. Correction of worksheets might be a problem for the teacher. It may become difficult for students to preserve the worksheets and place them based on the topics. All said and done worksheets are surely the aids to profit the student effectively. Although the advantages tend to be more when in comparison to the disadvantages. One ought not to ignore the detriments.

Tips on how to Creating a Qualified Dividends And Capital Gain Tax Worksheet 2016

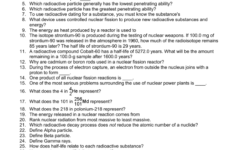

For starters divide the necessary topic into smaller, easily manageable parts (instead of taking a wide unit you could take lessons. In lessons a topic or a sub-topic). Parameters, for instance depth of topic, time required to finish, group of skills to be included and importantly the aim for which a given Qualified Dividends And Capital Gain Tax Worksheet 2016 is framed for, ought to be expressed.

Number of information plays a crucial role in designing the Qualified Dividends And Capital Gain Tax Worksheet 2016. Data may be collected from all the free resources for instance various text books of publications, journals, newspapers, encyclopedias, etc. The level of worksheet becomes the actual priority. The teacher should be confined to how much the students not add topics/material elsewhere their prescribed syllabus. See also this related articles below.