Personal Budget Finance 3 Tips & Guide

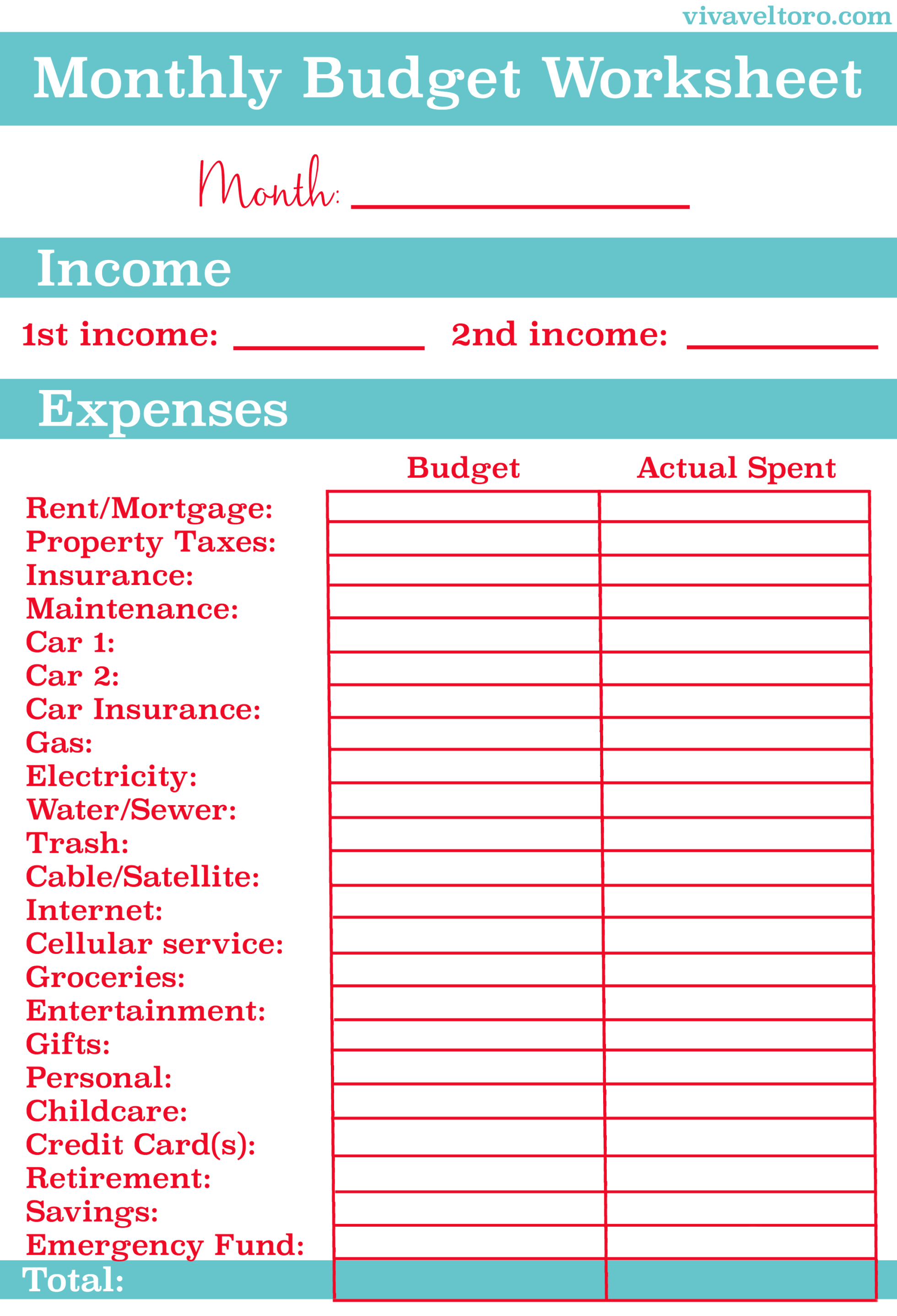

These steps will be able to help you create a budget. A budget ought to have a purpose or defined goal that is reached in a certain time frame. You may create a monthly or a yearly budget.

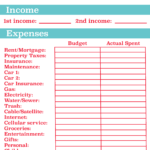

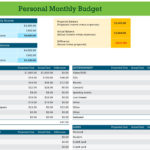

The very first step in making a budget is to recognize the quantity of money you have coming in. It’s simple to forget about a budget as soon as you are able to live off an endless supply of loan money, but bear in mind, a financial loan isn’t free money. Developing a personal budget is a great first step, but the most significant thing is to follow along with the budget. Though a month-to-month budget is usually the most reasonable time frame for which to set up an initial personal or household budget, there are various sources of revenue and expenses that don’t perfectly adhere to a month-to-month schedule.

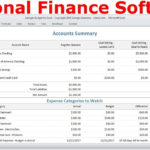

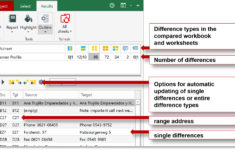

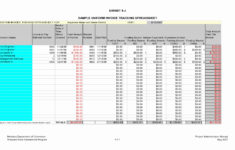

Just like allocation, there are a variety of methods offered for following a budget. It is crucial to realize that simply developing a budget isn’t enough. While you can definitely create a thriving personal budget with just a pencil and paper, many individuals discover that it’s very useful to use financial software.

What is Really Happening with Personal Budget Finance 3

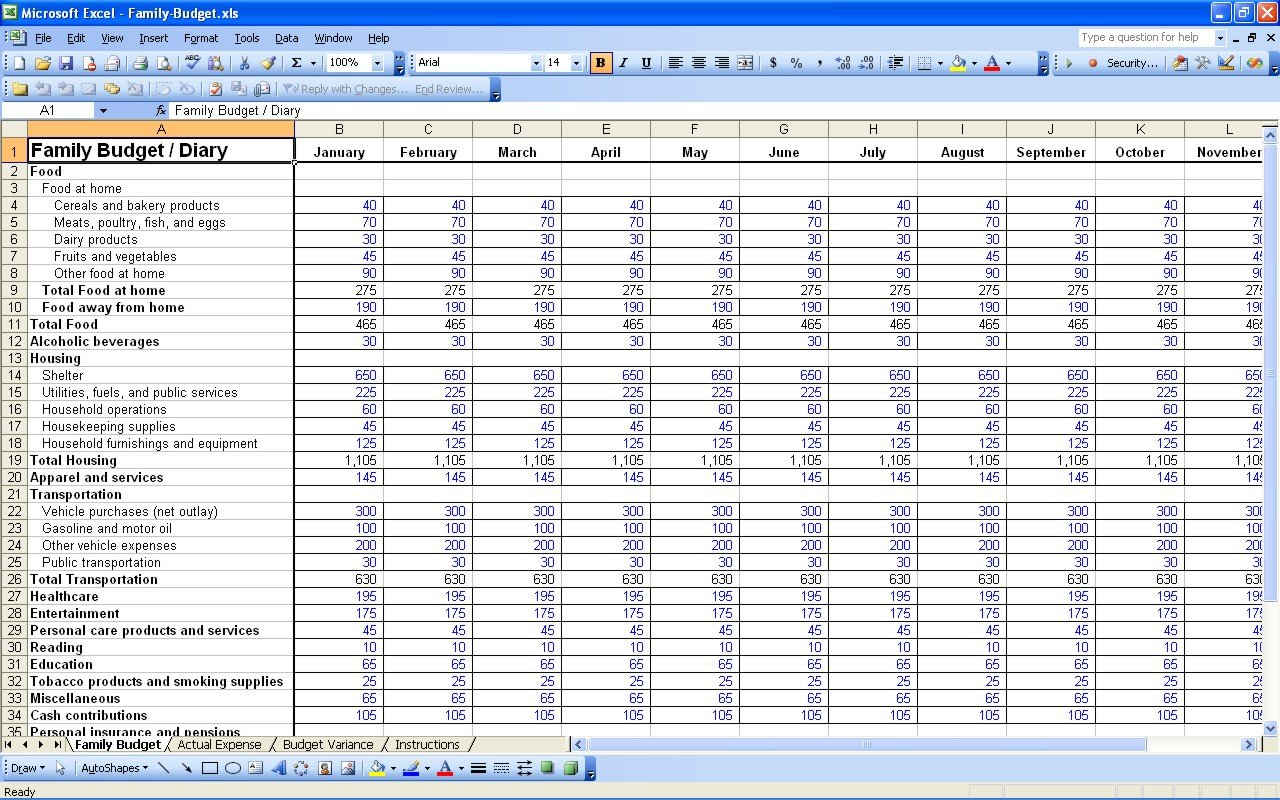

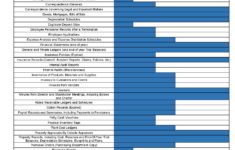

The budget gives you the ability to make financial decisions in advance, which makes it less difficult to cover all your expenses throughout the year. So let’s look at each one of the four varieties of budgets, together with tools that will help you regardless of your circumstance. Creating your very first budget can be hugely overwhelming.

The Little-Known Secrets to Personal Budget Finance 3

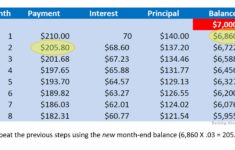

Having documented your earnings and spending, you can begin to observe where you have money left over or where you are able to cut back so you have money to put toward your aims. See what you’re spending and where you are able to save yourself money. A budget a highly effective tool for the reason that it permits you to figure out how and where you would like to devote your money. See what you’re spending and where you are able to conserve money, so that you may live the life you desire. By being comfortable with negotiating, you are going to save and earn more income in the future. As you earn more money, increase the total amount of money you use to pay off your debt.

You must be in a position to see precisely where you are spending money so that you understand how much you have left. For your budgeting to be profitable, you should understand how much money you earn in addition to how much disposable income you’ve got. Naturally, it isn’t always simple to pinpoint how to conserve money. If you discover you get a great amount of money in any 1 category, look at breaking it down into more detail. Because money which you put in your retirement fund now will have more time to grow through the ability of compound development.

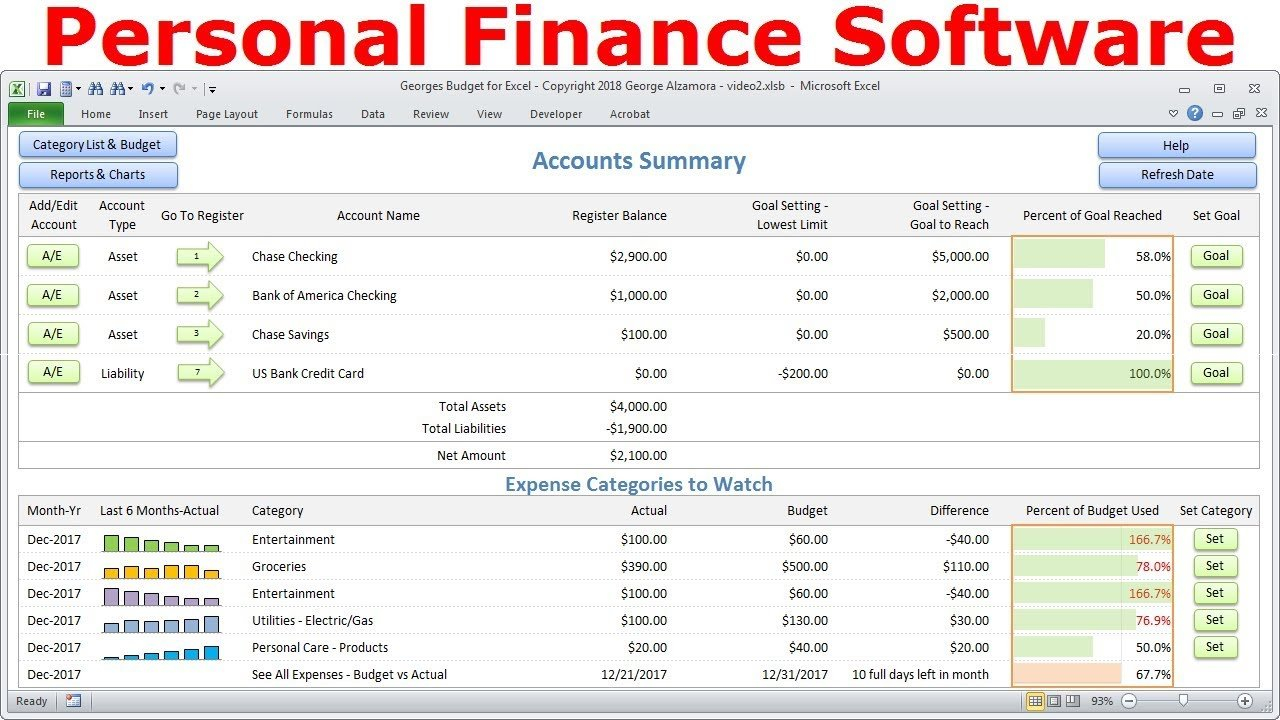

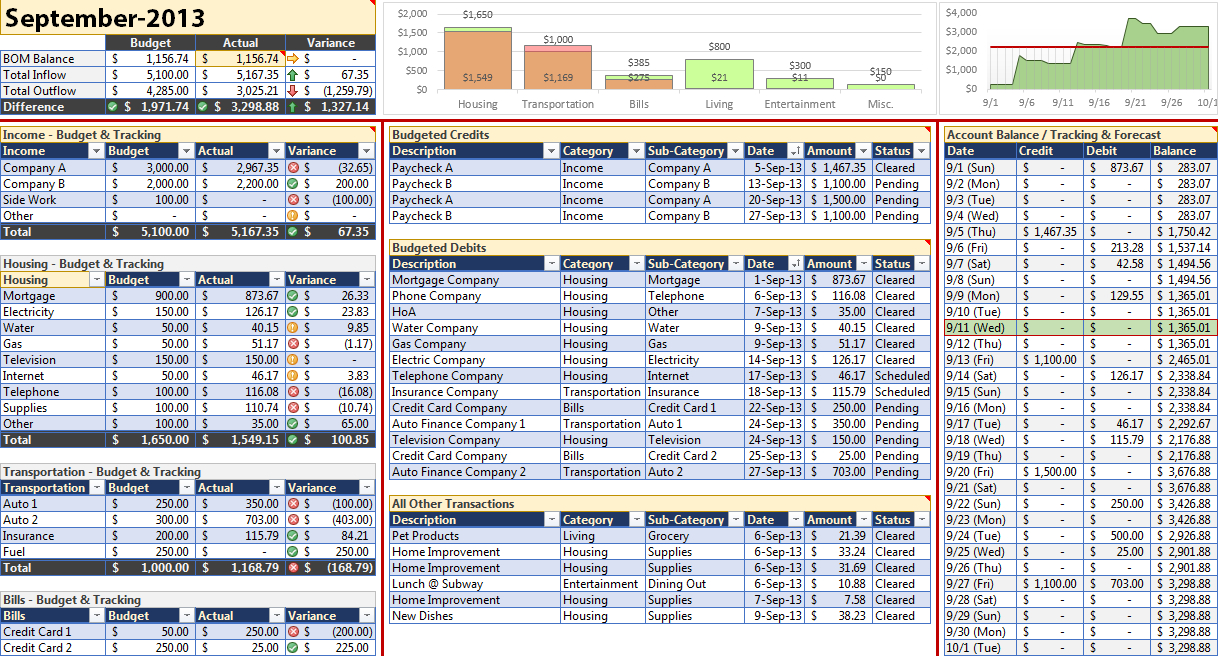

Personal finance software demands an initial time investment to establish and learn, but the program you select should be user-friendly and easy to navigate. It also allows you to manage your investments and record expenses on-the-go using a mobile app. The very best personal finance software is not hard to use and makes it possible to improve your money management. Good personal finance software offers you a visual representation of just how much money you’ve spent, and what exactly you have spent it on.