The Insider Secret on Heloc Mortgage Accelerator Spreadsheet Revealed

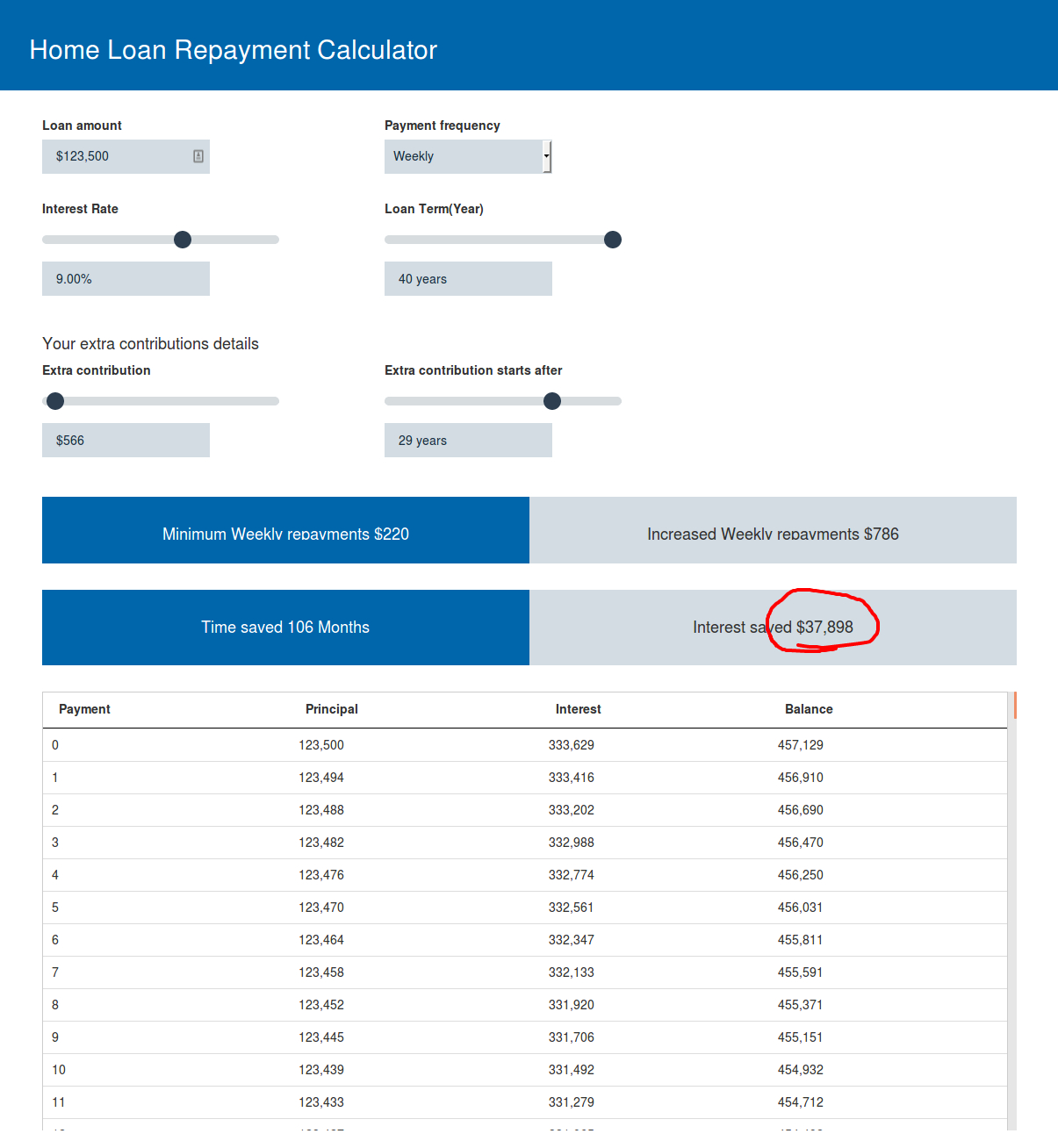

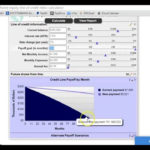

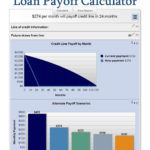

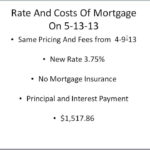

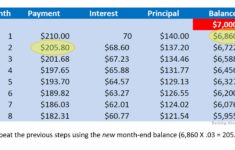

Let’s say you receive a mortgage. You do pay your mortgage earlier should you abide by the program, saving a good deal of mortgage interest in the practice. For instance, it’s possible to argue that all of the cash flow streaming into a mortgage might have been set in the stock exchange instead, or a portfolio of corporate bonds, or maybe a physical supply of gold. Whether you’ve got a present mortgage or are contemplating a new one, you should strongly think about establishing a biweekly loan payment schedule. Refinancing a current mortgage to a lower rate of interest rate can spare a bundle.

What the In-Crowd Won’t Tell You About Heloc Mortgage Accelerator Spreadsheet

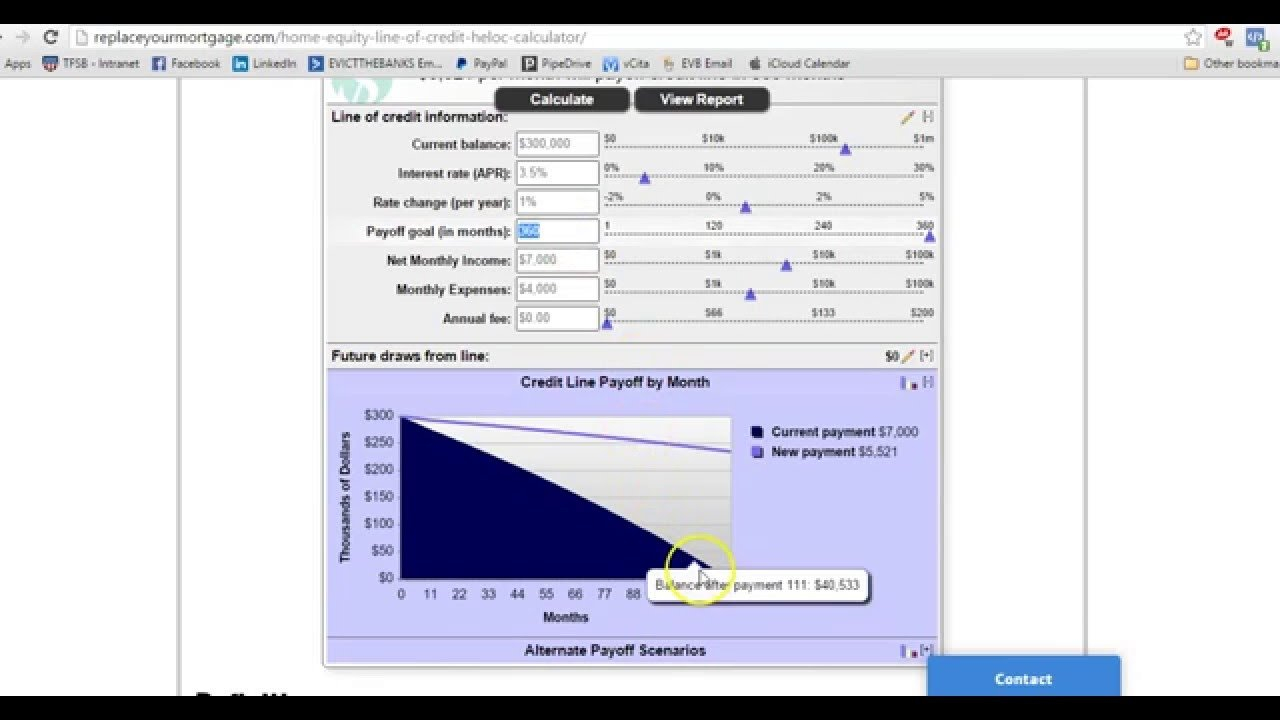

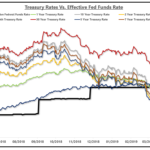

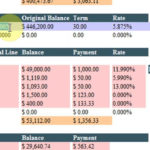

You don’t have to Replace Your Mortgage with a very first lien HELOC in many circumstances. At that rate, you will repay the mortgage in 223 months, or only shy of 20 decades. Outside the USA, fixed-rate mortgages are less popular, and in certain nations, true fixed-rate mortgages aren’t available except for shorter-term financial loans. While shopping for a house equity credit line (HELOC) rate, there’s more to know than when shopping for a conventional mortgage, since there are more factors that go into home equity interest prices.

In the instance of a business loan, the loan would have to be paid back in full and a new loan application procedure would need to be pursued for an extra loan. For most people, the interest-only loan is a great choice if you don’t intend to continue to keep your property for a very long time. By way of example, interest-only mortgage loans are extremely risky in the event the market price of the property falls during the loan period and you would like to sell the property.

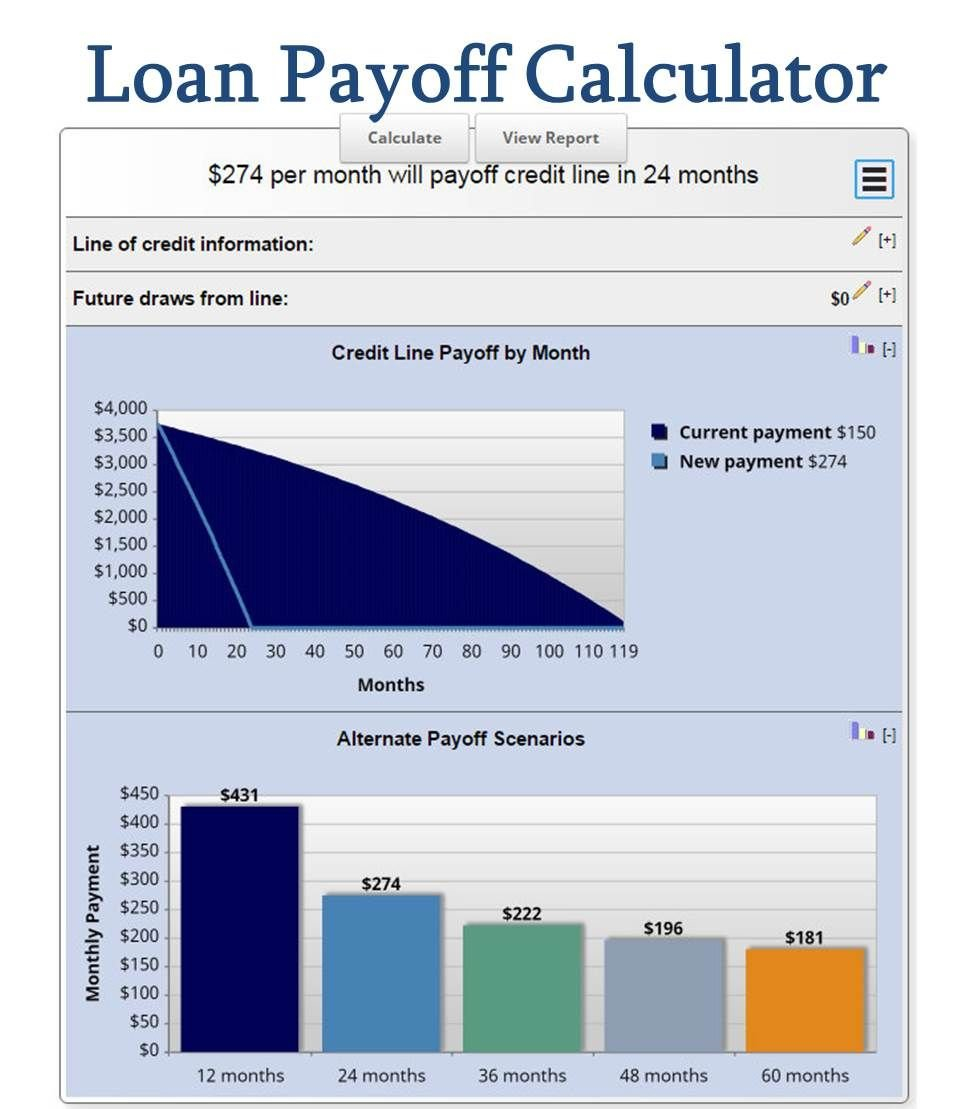

A line-of-credit loan can be compared to an enormous charge card. HELOC loans are better for folks that are paying their kid’s college expenses each year and other sorts of staggered periodic expenses. To begin with, it is a variable rate loan.

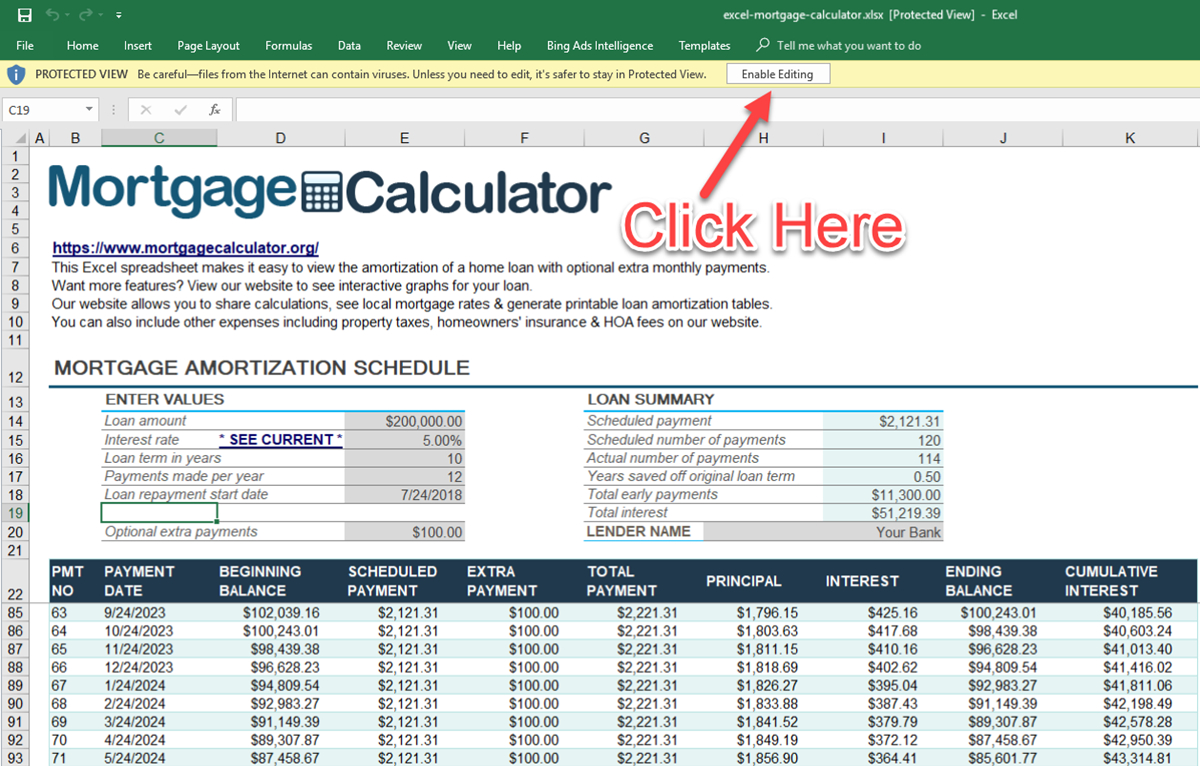

Interest is the sum you pay the bank for the privilege of borrowing for your house. As a consequence, you spend significantly less on mortgage interest, that’s the main selling point of the program. Your mortgage interest paid over the life span of your loan is dependent on your loan term and your mortgage rate of interest.

The Nuiances of Heloc Mortgage Accelerator Spreadsheet

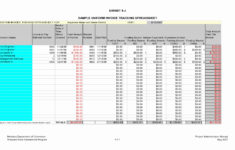

A HELOC can have a lump sum in addition to a monthly draw amount. It’s not essential to have a whole HELOC to prepay your mortgage. Don’t be quite as sure HELOC freezes won’t happen again later on. Speaking of credit, many individuals considering the HELOC want to understand how it will impact the borrower credit rating, if at all.

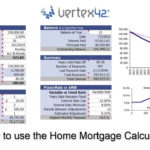

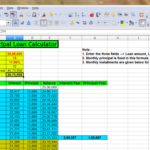

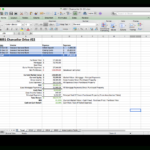

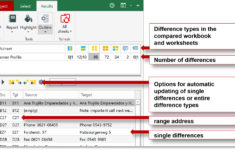

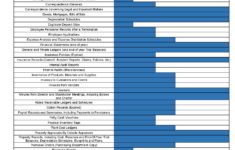

Spreadsheets can even be used to make tournament brackets. The spreadsheet contains several worksheets. It’s crucial for making a sterile budget spreadsheet.

Spreadsheets can continue to keep a watch out for your favourite player stats or stats on the complete team. Spreadsheets are some of the the most adaptable tools it’s possible to use at work. The upcoming downloadable spreadsheet contains the template used to carry out non-linear regression utilizing Microsoft Excel. Read also Heat Load Calculation Spreadsheet