The War Against Debt Repayment Spreadsheet

Your debt can vary from your college student loans, your charge card debt, mortgage, and any other debt which you want to pay off the moment you are able to. Whenever your very first debt is wholly paid, the rest of your snowball is subsequently applied to the NEXT debt, etc, until all the debts are paid. Listing the snowballed debts depends on the priority and volume of the debts. There’s debt that should be paid. It refers to anything that you owe someone else. Our tips will also aid you out should you acquire debts later on. When wanting to pay back debts the procedure can be rather difficult especially if you’re going through some financial strain.

Sure, it can take long but taking it one payment at one time is essential to making sure everything will work out fine for you in the long run. Every thriving payment you make ought to be regarded as a kind of encouragement to complete repaying your debt and reach your target on your set deadline. Like with credit cards, there are plenty of kinds of loans you are able to get so it’s important to see the the inner workings of each one to help you figure out which lender would be best suited for your unique requirements and situation. Paying off debt can be rather a challenge especially when you have tons of it. The charge card debt can be rather costly and difficult to repay.

Things You Should Know About Debt Repayment Spreadsheet

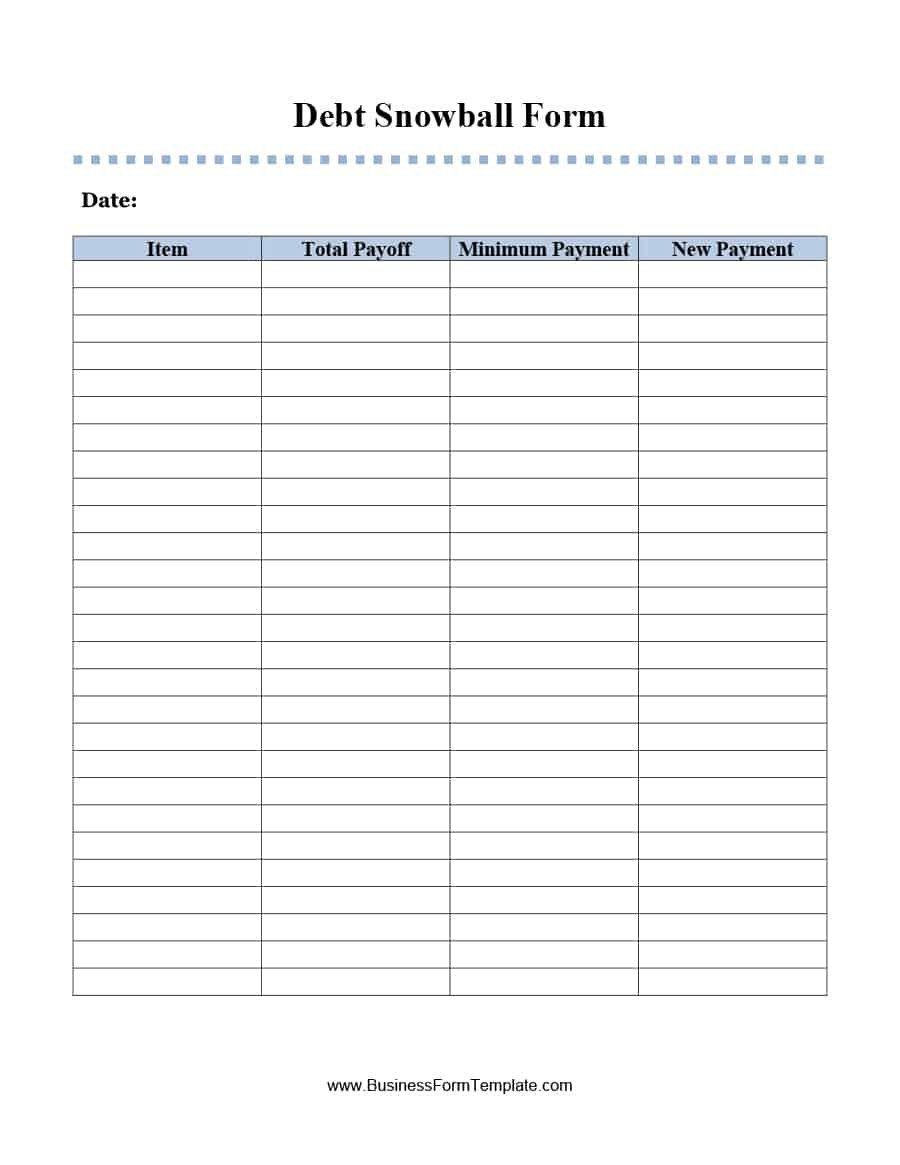

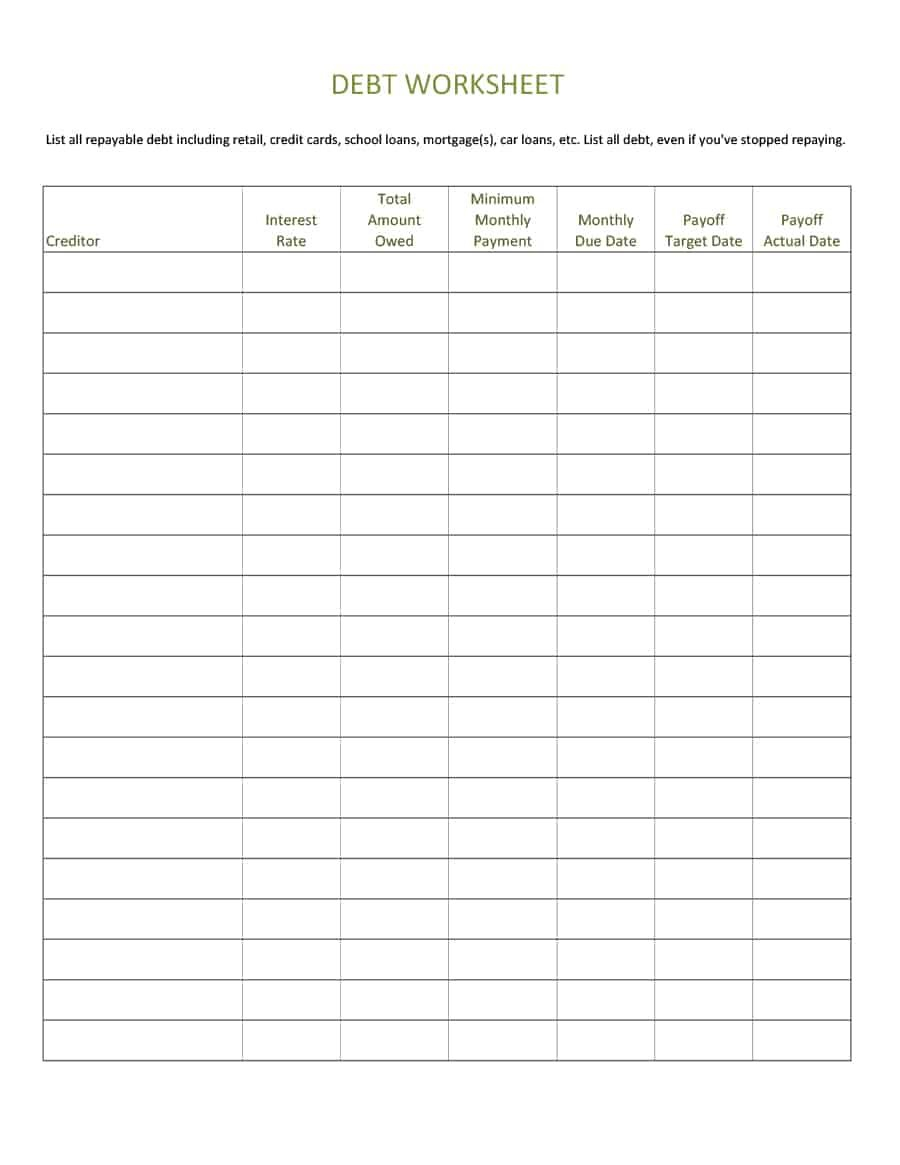

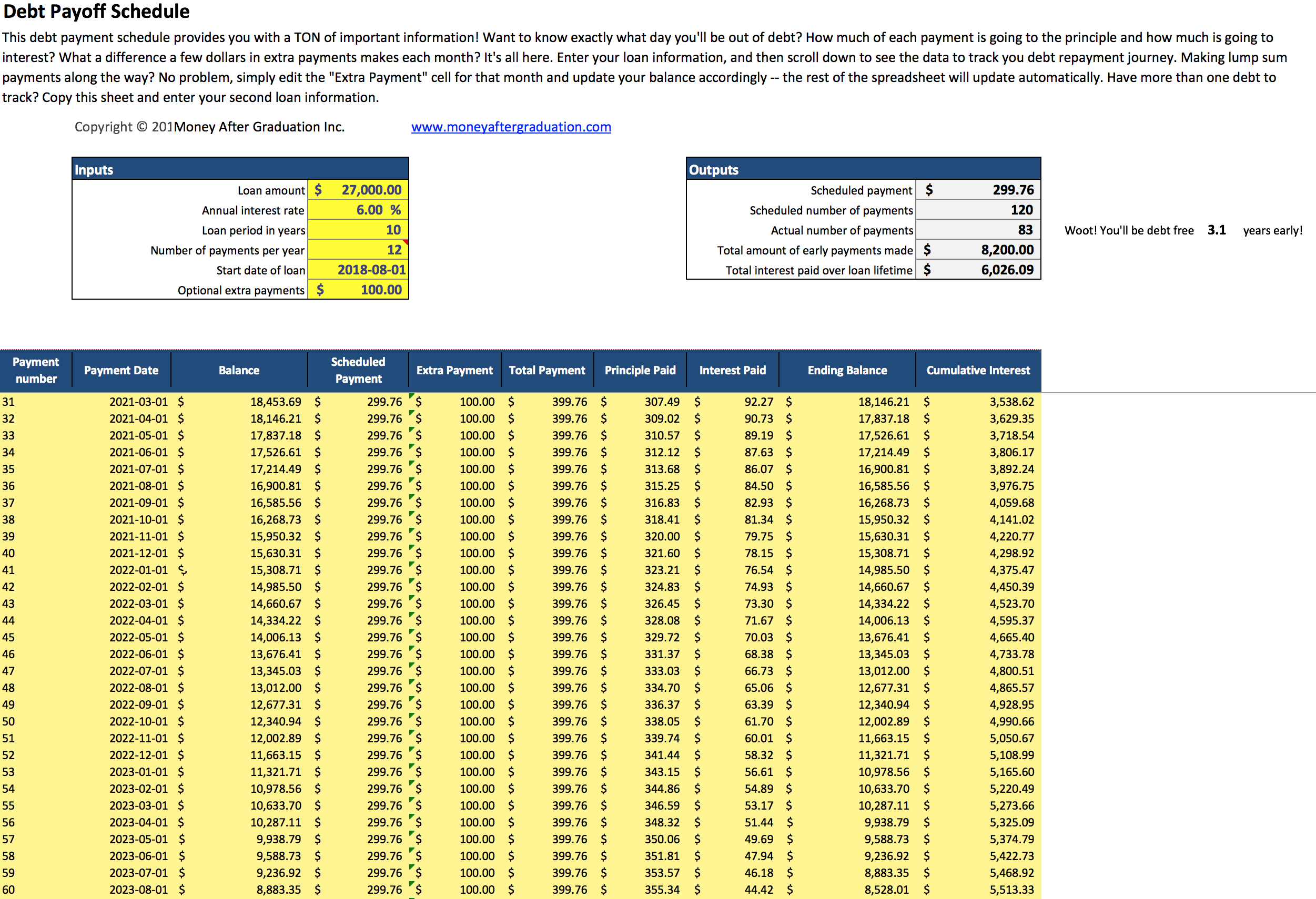

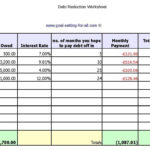

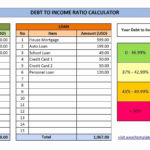

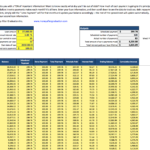

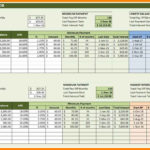

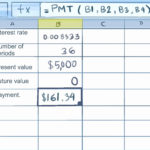

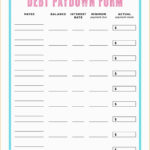

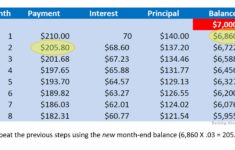

The spreadsheet includes a complete set of directions that it is possible to follow to fill it out yourself. Employing budgeting spreadsheets to deal with your finances is a simple and very affordable means to keep on top of your financial game. If you don’t have Excel, you’ll find absolutely free spreadsheet applications online to manage your financial plan. The spreadsheet has the subsequent columns and is pre-populated with a couple examples. Debt Payoff Calculator Spreadsheet is a good means to boost your productivity.

It’s possible for you to list dates bills are credited and you can also take advantage of the diary in accord with your budget to strategy for specific products or vacations. With it, you are going to be in a position to pay your accounts on time, save, and eliminate debt. You may list schedules bills are credited and you may also use the appointments in agreement with your spending budget to plan for specific items or holidays.

In the event you don’t schedule time to earn forecasts it doesn’t get accomplished. You’ve advised the opportunity to produce calls, make sure that you get the absolute most from that moment. Every time a spreadsheet gets too large or complex one wants to ask is there a digital remedy to create the same info. Whenever a spreadsheet gets overly large or complex one wants to ask is there a digital remedy to create exactly the same info. Whenever a spreadsheet gets too large or complex one wants to ask is there an electronic remedy to create the exact same info.

Being in debt is definitely something you don’t wish to be in for the remainder of your life. Getting out of debt isn’t simple, but using a very good plan and firm determination, it is totally possible. Getting out of your debt should not be considered a daunting undertaking.