The Inexplicable Puzzle Into Partial Exemption Calculation Spreadsheet Exposed

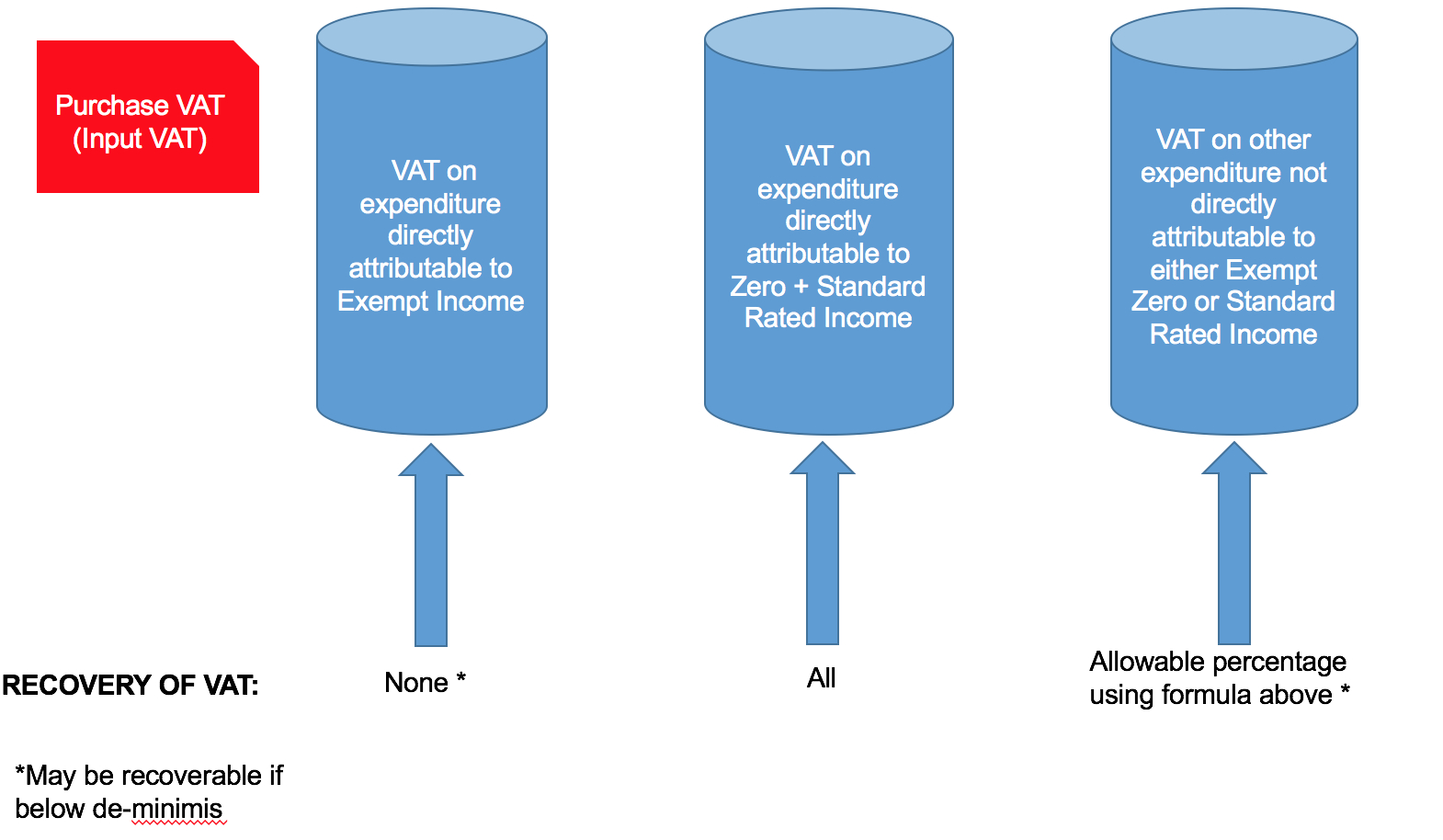

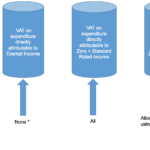

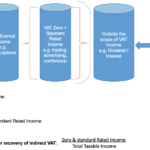

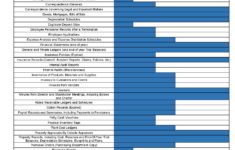

The exemption doesn’t exclude other kinds of income. It must be applied for annually. Partial exemption is almost always a tricky portion of the VAT system.

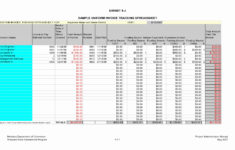

The different kinds of taxes you may want to pay are among the costs to examine. There are additional taxes to think about when providing your livery provider, including inheritance tax, so advice from your professional adviser is recommended. You also have to report income you’ve received constructively. When budgeting for in-kind contributions, it’s extremely important to ensure the in-kind expenses are budgeted along with the income. If you don’t stay informed about your income, you’re going to be fighting through bank statements from the prior year. You’re going to want to use gross income to figure your Depletion Allowance.

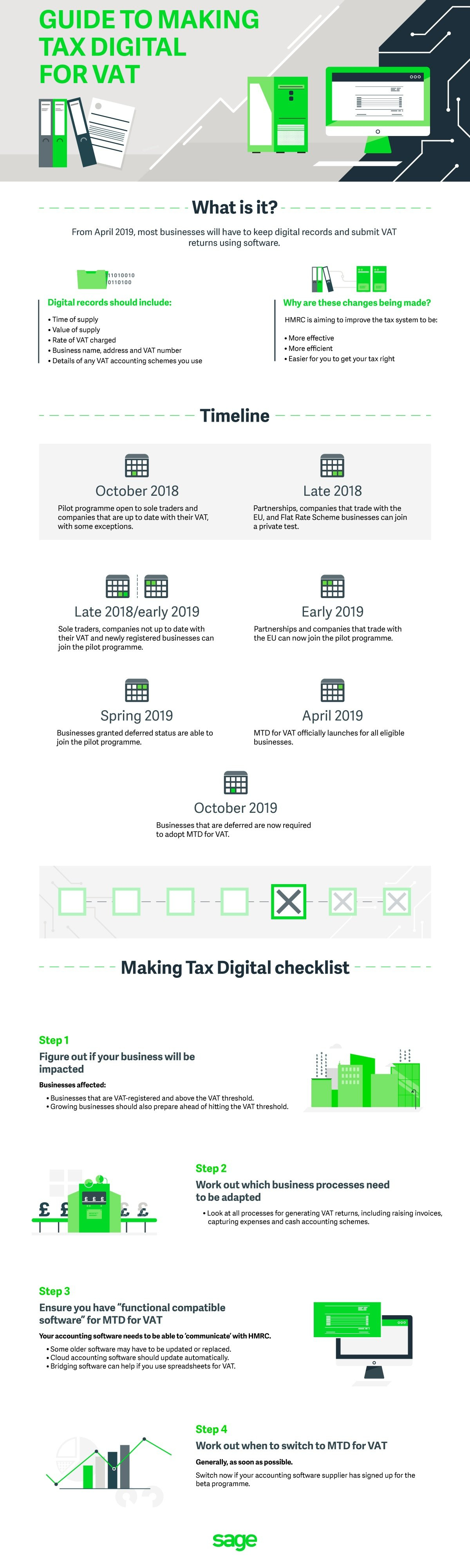

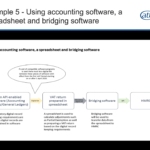

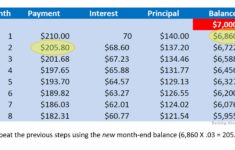

The calculation isn’t completed in the program. The calculator doesn’t take into consideration any potential tax reliefs which you could have the ability to take advantage off, but does permit you to enter different costs connected with each asset. It is not to be used as a substitute for due diligence in determining your tax liability to any government or entity. With colorful charts and instant effects, our EMI Calculator is simple to use, intuitive to comprehend and is quick to carry out.

You will frequently have to create documents without the assistance of examples, and you need to think about consulting a lawyer to help you. In the event of a review by CRA you’ll also understand where to locate the supporting documentation since they will request proof for the claim in question. Make sure to clearly and concisely describe the reason and offer any supporting documentation you may have.

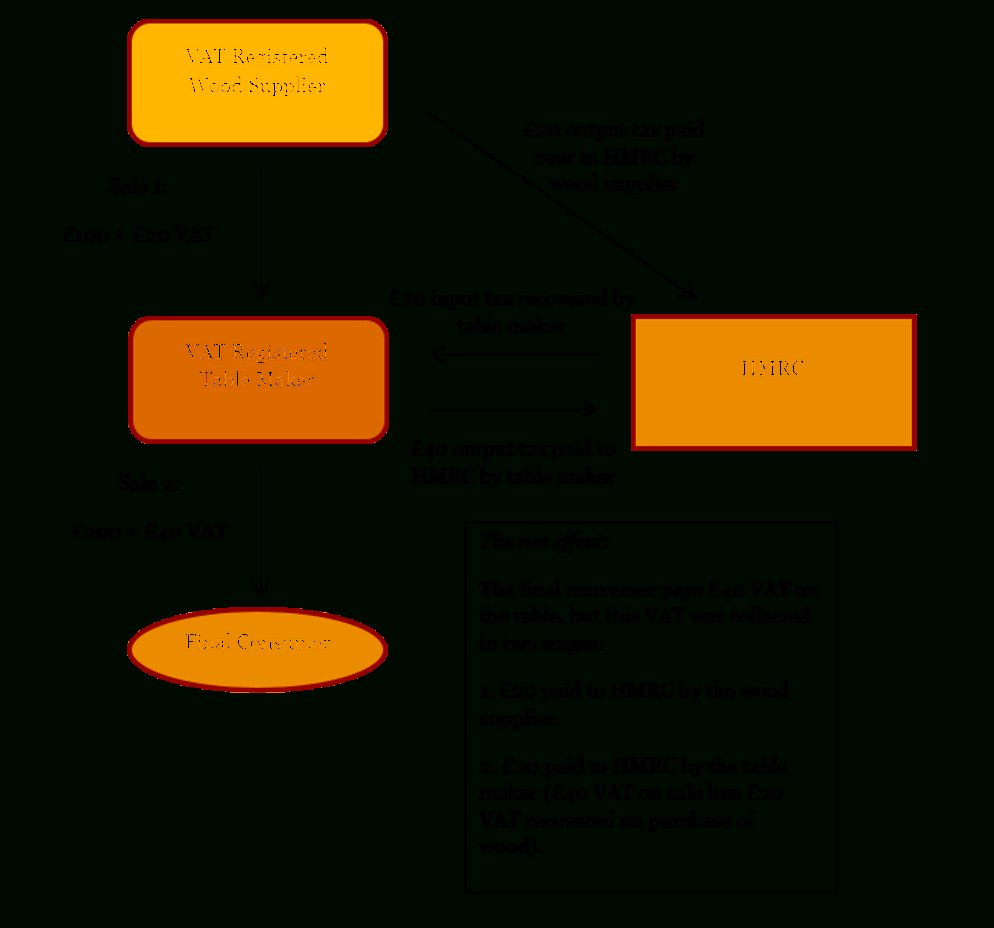

Some expenses are deductible, although the personal use of the house limits deductions. In addition, there are alternative procedures for calculating piece rate pay based on the job situation. You need to make sure all your costs are represented. Costs will vary based on the sort of care you need and your personal financial conditions. So, it’s important to understand how to convert the values. It’s possible to record the complete price and complete VAT due. In the instance of improvements to a rental house, you can deduct a part of that lost value each year over a certain number of years.

Who Else Wants to Learn About Partial Exemption Calculation Spreadsheet?

Now you own a template, both filled and blank, it is likely to offer you with a notion regarding how you have the ability to go about making your own. Instead, you might download a template from a third-party website, only ensure it’s in a Word format. The template is merely a starting point. If you want to create one in your, then here is a blank family tree template that you have the ability to download.

Rumors, Deception and Partial Exemption Calculation Spreadsheet

You may observe some of the templates are entirely free to use and several others call for a premium accounts. Templates might also be helpful as soon as you’re trying to lose or maintain your present weight. If you can’t track down the template that you require, you may pick on the Template Gallery add-on. Click Download” to pick the template that you must use. Double-click the template you want to download. The donation receipt template is quite simple to use.